Personal Finance 101: Essential Skills for Managing Money

By Samantha Lee

By Samantha LeePersonal finance management is a critical skill for achieving financial security and independence. Learning to manage money effectively allows you to build savings, control debt, and prepare for unexpected expenses. Here’s a comprehensive guide on the essential skills every individual should master to manage their finances confidently.

Setting Financial Goals

The first step in managing your money is setting clear financial goals. Whether it’s saving for a major purchase, building an emergency fund, or planning for retirement, having specific goals provides motivation and direction. Start by identifying short-term goals (saving for a vacation or paying off credit card debt) and long-term goals (buying a home or retiring comfortably). Write them down and break them into actionable steps to make them achievable.

Budgeting Basics

Budgeting is the cornerstone of personal finance. A budget helps you track your income and expenses, ensuring you’re not spending more than you earn. Begin by listing your monthly income sources and essential expenses, such as rent, utilities, groceries, and debt payments. Allocate a portion of your income for discretionary spending, like dining out or entertainment, but ensure you’re setting aside money for savings. Budgeting software and apps can be helpful in keeping your finances organized and on track.

Building an Emergency Fund

An emergency fund is a financial safety net that covers unexpected expenses, such as medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses in a separate, easily accessible account. Having an emergency fund prevents you from relying on credit or dipping into long-term investments during tough times. Start small if necessary, and consistently contribute to this fund until you reach your target.

Understanding Credit and Debt

Managing credit and debt effectively is crucial for maintaining financial health. Credit allows you to make purchases and pay later, but it can lead to debt if not managed wisely. Understand the basics of credit scores, which influence your ability to borrow money and the interest rates you receive. Pay off high-interest debt first, as it can quickly accumulate and strain your finances. Make timely payments and keep your credit card balances low to improve your credit score.

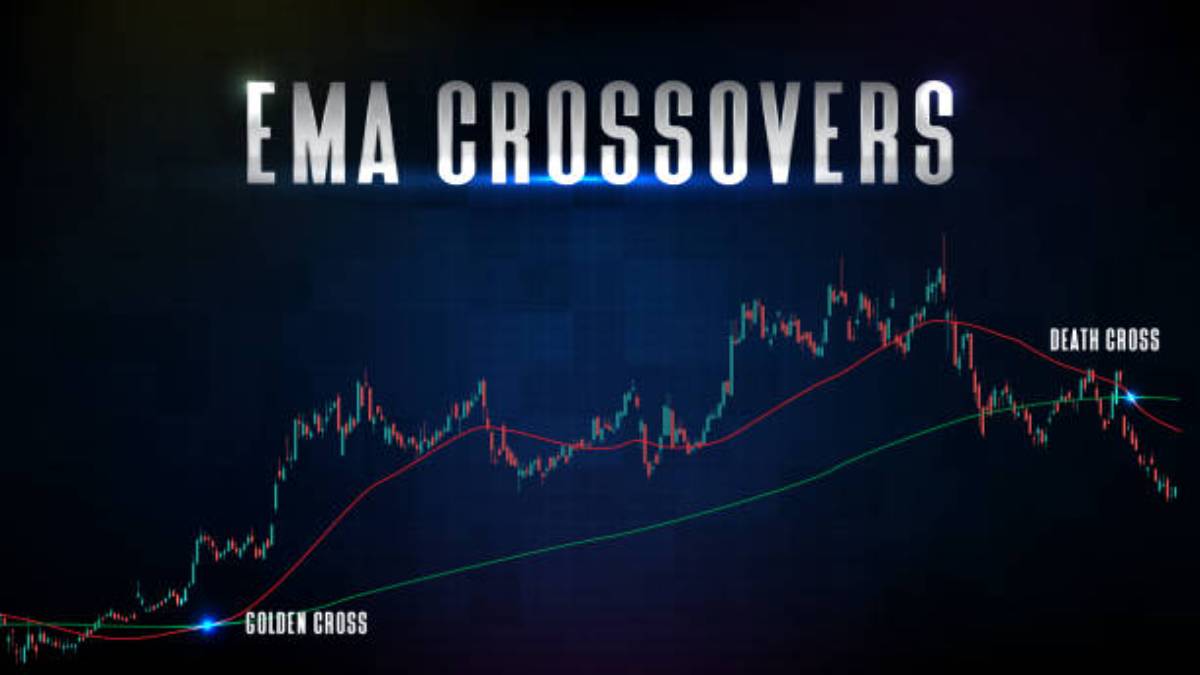

Saving and Investing for the Future

Saving and investing are essential for building wealth and ensuring a comfortable future. Start by setting aside a portion of your income in a savings account for short-term goals. For long-term growth, consider investing in assets like stocks, bonds, or mutual funds. The earlier you start investing, the more you benefit from compound interest, which can significantly increase your wealth over time. If you’re new to investing, consider consulting a financial advisor or using a robo-advisor to guide your investment choices.

You might also like

1. Options Trading in the USA: A Beginner’s Guide2. The Impact of Inflation on Personal Finances3. How to Build Wealth in America: Smart Financial Strategies4. Why You Should Stop Saving and Start Investing Today!Managing Expenses Wisely

Controlling your spending habits is key to financial success. Identify areas where you can cut unnecessary expenses, such as dining out frequently or subscription services you rarely use. Small changes, like cooking at home, using public transportation, or limiting impulse purchases, can add up to substantial savings. Track your spending regularly and evaluate your needs versus wants to ensure you’re making mindful financial decisions.

Planning for Retirement

Retirement planning is an essential part of financial management. Even if retirement seems far off, the earlier you start, the better. Contribute to a retirement account, such as a 401(k) or IRA, which offers tax benefits and potential employer contributions. Regular contributions over time will grow significantly, thanks to compound interest. Consider increasing your contributions as your income grows, and consult a financial advisor if you need help choosing the right retirement plan for your goals.

The Importance of Insurance

Insurance protects your financial well-being by covering unexpected costs related to health, home, car, and more. Health insurance is essential, as medical expenses can be overwhelming without coverage. Additionally, consider life insurance if you have dependents who rely on your income. Evaluate your insurance needs periodically and adjust your coverage as your circumstances change to ensure adequate protection.

Conclusion

Mastering personal finance skills is a journey that requires practice and discipline. By setting financial goals, budgeting, building an emergency fund, and investing wisely, you can achieve financial security and freedom. Embrace these foundational skills and make personal finance a priority in your life. With consistency and smart choices, you’ll be well on your way to a brighter financial future.

About the author

By Samantha Lee

By Samantha LeeSamantha Lee is a seasoned finance writer with over 8 years of experience helping millennials and Gen Z take control of their money. With a background in economics and a passion for demystifying complex financial concepts, Ananya shares actionable tips on budgeting, investing, and building long-term wealth. Her mission is to make financial literacy accessible, relatable, and empowering — no jargon, just smart money moves.

More like this

Government Policies and Their Effect on Personal Finances

Government policies play a crucial role in shaping personal finances, influencing everything from taxes and interest rates to employment opportunities and social benefits. Understanding these policies can help individuals make informed financial decisions.

The Role of Cryptocurrencies in the American Financial System

Cryptocurrencies have become an integral part of the American financial system, influencing investment strategies, payment solutions, and regulatory policies. As digital assets gain mainstream acceptance, their impact continues to grow.

How to Build a Strong Investment Portfolio in the U.S.

Building a strong investment portfolio requires strategic planning, diversification, and a clear understanding of financial goals. A well-structured portfolio helps manage risk while maximizing returns over time.

Best High-Yield Savings Accounts in the USA

High-yield savings accounts offer a great way to grow your money with competitive interest rates while maintaining easy access to your funds. Choosing the right account can help maximize your savings potential.

Personal Finance Tips for Managing Debt in the U.S.

Managing debt effectively is crucial for financial stability. By implementing smart strategies, individuals can reduce their financial burden and work toward a debt-free future.

The Impact of Interest Rate Changes on Loans and Mortgages

Interest rates play a crucial role in determining the cost of borrowing money for loans and mortgages. Changes in interest rates can significantly impact monthly payments, affordability, and long-term financial planning.

Understanding Credit Scores: How to Improve Yours

Your credit score plays a crucial role in financial health, affecting loan approvals, interest rates, and even job opportunities. Understanding how credit scores work and how to improve them can lead to better financial stability.

Retirement Planning: Best Strategies for Americans

Planning for retirement is essential to ensure financial security in later years. By adopting smart strategies, Americans can build a comfortable nest egg and enjoy financial independence.

How Inflation Affects Your Savings and Investments

Inflation erodes the purchasing power of money, making it a crucial factor for savers and investors. Understanding how inflation impacts savings and investments can help you make informed financial decisions.

The Future of Banking in the U.S.: Digital vs. Traditional

The U.S. banking industry is undergoing a major transformation with the rise of digital banking. Traditional banks face increasing competition from online financial institutions, leading to a shift in how consumers manage their money.

Managing Debt in the USA: Tips for Financial Freedom

Debt can be a major financial burden, but with the right strategies, you can regain control and achieve financial freedom. Understanding how to manage and reduce debt effectively is key to long-term financial stability.

Top Investment Opportunities in the U.S. for 2025

The U.S. investment landscape is evolving rapidly, offering new opportunities across various sectors. As 2025 approaches, investors can explore emerging trends and strategic investments to maximize their financial growth.